Introduction

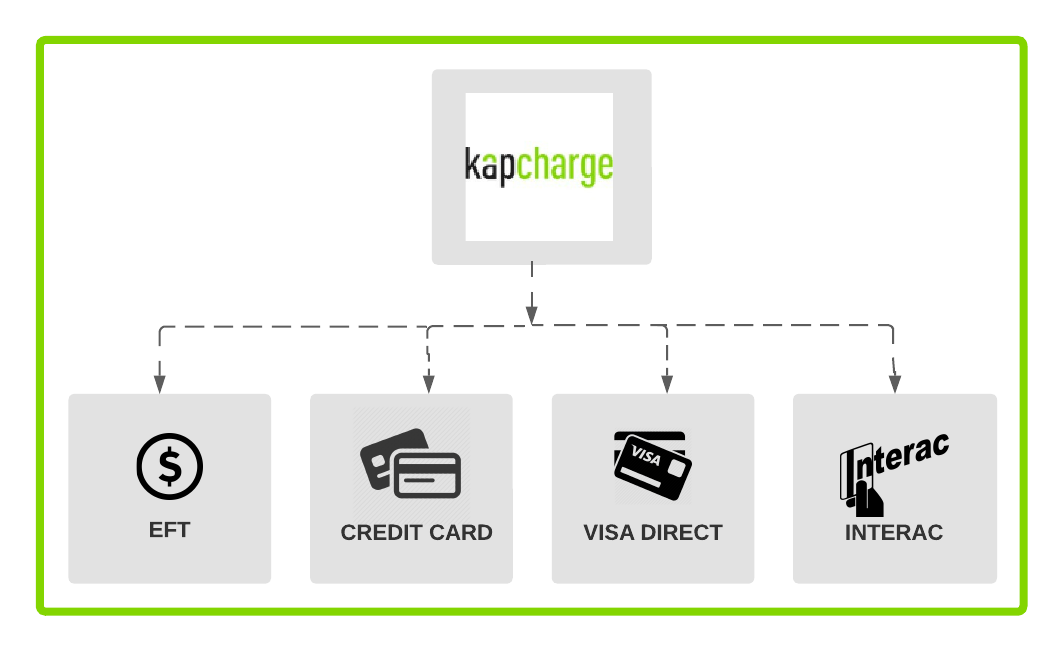

Kapcharge serves as an online payment infrastructure, offering a comprehensive suite of software and APIs tailored for businesses of various sizes. Our technology empowers businesses to accept payments, facilitate payouts, and efficiently manage their financial transactions.

Through cutting-edge innovation, we automate the processing of both inbound and outbound payments. Kapcharge streamlines payment processing services by providing a unified API connecting businesses with the banking and payment ecosystem.

Our commitment lies in delivering the most secure and dependable payment processing service across Canada and the United States, supported by robust risk management and data analytics. With a fully integrated suite of payment solutions, we equip our customers with everything they need to handle payment acceptance and payout processes seamlessly.

Financial terminologies

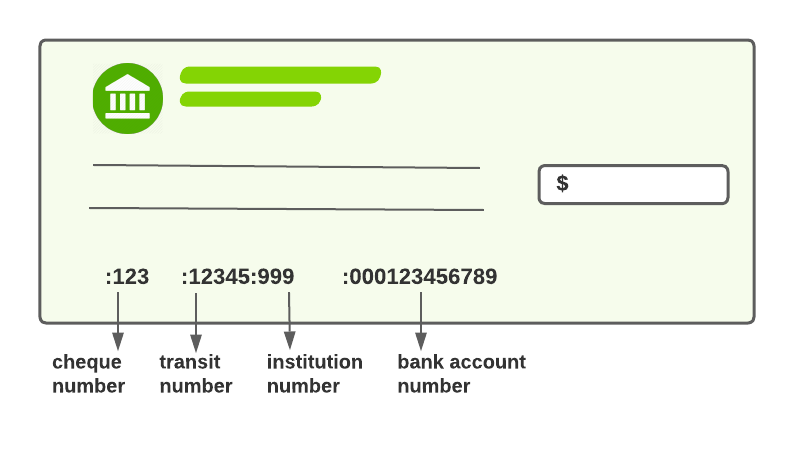

| Canada | Description |

|---|---|

| Institution Number | An institution number is the three-digit code assigned to each bank to uniquely identify it. |

| Transit Number | A transit number is a 5-digit branch number that can be found on the bottom of your personal cheques. |

| Card Number | Most of the credit cards and debit cards have a 16-digit unique number. |

| CVV | The CVV(Card Verification Value) number is a three-digit or four-digit number depending on your card network. |

| Expiry Month | The expiration date can be found on the card, written as XX/XX (month and year)pos. |

| Expiry Year | The expiration date can be found on the card, written as XX/XX (month and year). |

Kapcharge Payment Gateway

Transaction Types

| Description | Transaction Types |

|---|---|

| Collect | Allows the transfer of funds from a customer's bank account to your merchant account. This transaction is completed in real time. |

| Pay | Allows the transfer of funds from a merchant account directly to a customer's bank account. This transaction is completed in real time. |

Payment Methods

| Method | Description | Duration | Send Transaction | Request Transaction |

|---|---|---|---|---|

| EFT | Electronic funds transfer between banks | 3 times a day | Yes | Yes |

| Interac | Online e-transfers, user receives an e-mail or SMS | Immediately | Yes | Yes |

| Visa Direct | Visa rails to push funds directly to visa card | Immediately | Yes | No |

| V/MC Debit | V/MC Debit payments/checkout to collect funds | Immediately | No | Yes |

API Specification

API Introduction

This technical integration specification document explains the KAPCHARGE Payment Gateway new API. It enables merchant systems to post real-time transaction requests to KAPCHARGE Payment Gateway.

This part of the documentation discusses the technical requirements for real-time integration only. For specifications relating to Batch File Uploading or using Virtual Terminals to create and send the transactions online, please refer to the other services of the Kapcharge.

API Specifics

Kapcharge Swagger API

OAuth GET AccessToken

Bearer Token Authorization is used for all API requests. Multiple API calls can be made securely without requiring authorization each time with a Bearer Token.

Payload

Authentication Payload

{

"clientId":{{ClientID}}

"clientSecret":{{ClientSecret}}

}

HTTP Request

Method: POST

Endpoint: {{Application URL}}/api/v1/OAuth/token

Make sure to replace

{{Application URL}}with API Application URL as per the environment.

curl --location -g --request POST '{{Application URL}}/api/v1/OAuth/token'

The above command returns JSON structured like this:

{

"accessToken": "{JWT Token}",

"tokenType": "Bearer",

"expiresIn": 3600,

"expiresOn": 1666298431

}

| Parameter | Type | Mandatory |

|---|---|---|

| clientId | String | Yes |

| clientSecret | String | Yes |

Responses

| Parameter | Description |

|---|---|

| accessToken | The authorization token that needs to be used throughout the API request. |

| tokenType | This will always be "Bearer" token type. |

| expiresIn | This is token expiration time (seconds). |

| expiresOn | This is token validation end-time (epoch time). |

Transaction API for EFT & Interac

Create Transactions

Sample Request Payload

Sample Request Payload

[

{

"MerchantId": "TEST_123-KC",

"Currency": "CAD",

"ClientReference": "JohnDoe",

"AmountInCents": 100,

"DueDate": "2023-01-13",

"TransactionFlow": "Debit",

"TransactionMethod": "Interac",

"IsInteracViaSMS": "true",

"Description":"Sample payload of a transaction",

"Customer": {

"FirstName": "John",

"LastName": "Doe",

"CompanyName": "Sample Co",

"AddressLine1": "1234 Est",

"AddressLine2": "App #208",

"City": "Montreal",

"Country": "CA",

"Province": "QC",

"PostalCode": "H3Z2H7",

"Email": "[email protected]",

"PhoneNumber": "6477891234"

},

"CustomerBankAccount": {

"InstitutionName": "ABC Bank",

"InstitutionNumber": "001",

"AccountNumber": "1234567",

"TransitNumber": "12345",

"AccountOwnershipType": "INDIVIDUAL"

},

"PaymentAuthentication": {

"HasSecurityQuestionAndAnswer": true,

"Question": "What colour is my shirt?",

"Answer": "BLUERAIN"

},

"DeviceInfo": {

"IpAddress": "1.0.0.125",

"DeviceFingerprint": "3p2yZ#WsyQQC99VANt6yxG7n6RU"

}

}

]

HTTP Request

Method: POST

Endpoint: {{ Application Url }}/api/v1/transaction

Transaction Request

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

| MerchantId | String | Yes | Merchant id (maximum 15 characters). |

| Currency | String | Yes | Either "CAD" or "USD" only (maximum 3 characters). |

| ClientReference | String | Yes | Client Reference (maximum 100 characters). |

| AmountInCents | Integer | Yes | Transaction amount in cents. |

| DueDate | String | Yes | Due date for the transaction (Format: YYYY-MM-DD). |

| TransactionFlow | String | Yes | Either "Collect" or "Pay" only. |

| TransactionMethod | String | Yes | Either "EFT" or "Interac" only. |

| IsInteracViaSMS | String | No | The value should be "true" to send money via SMS and "false" by default. |

| Customer | Object | Yes | Pass the Customer object with all the required details as seen in Customer below. |

| CustomerBankAccount | Object | Yes (EFT only) | Pass the Customer Bank Account object with all the required details as seen in Customer Bank Account below. |

| PaymentAuthentication | Object | No | Pass the PaymentAuthentication object with all the required details as seen in Payment Authentication below (Only when Transaction Method is Interac). |

| DeviceInfo | Object | No | Pass the DeviceInfo object with all the required details as seen in Device Info below (Only when Transaction Method is Interac). |

Customer

| Parameter | Type | Mandatory EFT | Mandatory Interac | Description |

|---|---|---|---|---|

| FirstName | String | ✓ | ✓ | First Name of the customer (maximum 100 characters) |

| LastName | String | ✓ | ✓ | Last Name of the customer (maximum 100 characters) |

| CompanyName | String | ✓ | ✓ | Company Name of the customer (maximum 100 characters) |

| AddressLine1 | String | ✓ | ✗ | Billing Address Line 1 (maximum 255 characters) |

| AddressLine2 | String | ✗ | ✗ | Billing Address Line 2 (maximum 255 characters) |

| City | String | ✓ | ✗ | Billing address city (maximum 100 characters) |

| Country | String | ✓ | ✓ | Billing address country (maximum 4 characters) |

| Province | String | ✓ | ✗ | Billing address state/province (maximum 100 characters) |

| PostalCode | String | ✓ | ✗ | Billing address postal code (maximum 20 characters) |

| String | ✓ | ✓ | Customer email (maximum 100 characters) | |

| PhoneNumber | String | ✓ | ✓* | Phone number (maximum 50 characters, no special characters accepted) |

Note: Customer First Name and Last name are required when AccountOwnershipType is INDIVIDUAL and Company Name is required when AccountOwnershipType is BUSINESS.

*Required for Interac when IsInteracViaSMS="true"

curl --location -g --request POST '{{ Application Url }}/api/v1/transaction'

Make sure to replace

{{Application Url}}with Application Url as per the environment. For any parameter related to Country ,please use the alpha-2 standard.

Follow the link below:

ISO Country Codes.

The above command returns JSON structured like this:

Status Code : 200 OK

[

{

"kapchargeTransactionId": 12345679,

"clientReference": "JohnDoe",

"transactionStatus": "Accepted",

"transactionFlow": "Pay",

"amountInCents": 100,

"errors": [

{

"message": ""

}

]

}

]

Status Code : 400 Bad Request

{

"title": "One or more validation errors occurred.",

"status": "400",

"detail": "Please refer to the errors property for additional details.",

"instance": "/api/v1/Transaction",

"errors": {

"[0].Customer.Province": [

"The Province is required. Invalid Canadian province"

]

}

}

Status Code : 500 Internal Server Error

{

"title": "An error has occured",

"detail": "Please refer to the errors property for additional details",

"status": 500,

"errors": [

{

"code": "InternalServerError",

"message": "The Amount must be greater than 0.00.",

"developerMessage": ""

}

]

}

Customer Bank Account - Enhanced Specifications

| Parameter | Type | Format | Constraints | Mandatory | Description |

|---|---|---|---|---|---|

| InstitutionName | String | Alphabetic | Max 100 chars | No | Official name of the customer's financial institution. Helps with troubleshooting. |

| InstitutionNumber | String | Numeric | Exactly 3 digits | Yes (for EFT only) | The 3-digit Canadian bank code (e.g., "001" for Bank of Montreal). |

| AccountNumber | String | Numeric | 5-12 digits | Yes (for EFT only) | Customer's bank account number without dashes or spaces. |

| TransitNumber | String | Numeric | Exactly 5 digits | Yes (for EFT only) | The 5-digit branch identification number printed on checks. |

| AccountOwnershipType | String | Enum | "BUSINESS" or "INDIVIDUAL" only | Yes (for EFT and Interac) | Determines the type of account ownership and validation rules applied. |

Payment Authentication (For Interac Only) - Enhanced Specifications

| Parameter | Type | Format | Constraints | Mandatory | Description |

|---|---|---|---|---|---|

| HasSecurityQuestionAndAnswer | Boolean | true/false | Must be true for Interac Pay | Yes | Must be set to true for all Interac transactions. Controls whether security Q&A is required for the Interac transfer. |

| Question | String | Alphanumeric | 5-40 chars | Yes* | Security question for recipient to answer when claiming funds. |

| Answer | String | Alphanumeric | 3-25 chars Case sensitive |

Yes* | Answer to security question. Must be communicated to recipient separately. |

*Required because HasSecurityQuestionAndAnswer must be true for Interac.

Device Info (For Interac Only)

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

| IpAddress | String | Yes | The IP address of the UserId, the sender, of the funds. Required if Accounts Payable with Interac, and peer-to-peer enabled. |

| DeviceFingerprint | String | Yes | A unique identifier supplied by Kapcharge for DeviceFingerprint is always required. |

Responses

| Parameter | Description |

|---|---|

| kapchargeTransactionId | The unique transaction ID generated by Kapcharge. |

| clientReference | Transaction reference provided by the client. |

| transactionStatus | Refer KAPCHARGE Bank Status Response Codes here. |

| transactionFlow | Either "Collect" or "Pay". |

| amountInCents | Transaction amount in cents. |

| listOfErrors | Error message (only when there is some error processing request). |

Get a specific transaction

Get a specific transaction

curl --location -g --request GET '{{ Application Url }}/api/v1/transaction/12345679'

Make sure to replace

{{Application Url}}with Application Url as per the environment.

HTTP Request

Method: GET

Endpoint: {{ Application Url }}/api/v1/transaction/<TransactionID>

The above command returns JSON structured like this:

{

"kapchargeTransactionId": 12345679,

"clientReference": "SmithDoe",

"transactionStatus": "Accepted",

"transactionFlow": "Collect",

"amountInCents": 200,

"responseCode": "800", //For Returned/Declined transactions

"availabledate" : "2022-10-26T15:36:30.265Z",

"declineddate" : "2022-10-27T15:36:30.265Z", //For Returned/Declined transactions

"transactionMethod": "EFT",

"transactionEvents": [

{

"eventDate": "2022-10-25T17:46:38.791Z",

"eventType": "SUBMITTED",

"description": "CREATED_BY_EFT_FILE_JOB"

},

{

"eventDate": "2022-10-25T15:36:30.265Z",

"eventType": "CREATED"

}

]

}

This endpoint retrieves a specific transaction request based on transaction id.

Responses

| Parameter | Description |

|---|---|

| kapchargeTransactionId | The unique transaction ID generated by Kapcharge. |

| clientReference | Transaction reference provided by the client. |

| transactionStatus | Refer KAPCHARGE Bank Status Response Codes here. |

| transactionFlow | Either "Collect" or "Pay". |

| amountInCents | Transaction amount in cents. |

| responseCode | The response code of the transaction. Refer to the Decline Codes section for specific values. |

| availabledate | Date that EFT transaction is settled to wallet. |

| declineddate | Date that transaction was Returned or Declined. |

| transactionMethod | The paymentmethod used for the transaction (e.g., "EFT", "Interac", "CreditCard", "VisaDirect"). |

Search transactions

Search transactions

curl --location -g --request GET '{{Application Url}}/api/v1/Transaction/search?MerchantId=mk2'

Make sure to replace

{{Application Url}}with Application Url as per the environment.

HTTP Request

Method: GET

Endpoint: {{ Application Url }}/api/v1/transaction/search?<>Parameters

The above command returns JSON structured like this:

{

"results": [

{

"createdDateTime": "2023-11-20T00:01:26.7179746",

"declineddate" : "2022-10-27T15:36:30.265Z",

"merchantId": "KPC_211-TEST",

"kapchargeTransactionId": 12648286,

"clientReference": "232145214",

"transactionStatus": "Returned",

"responseCode": "800", //For Returned/Declined transactions

"transactionFlow": "Pay",

"transactionMethod": "EFT",

"amountInCents": 110,

"customer": {

"customerFullName": "CustomerFirstName CustomerLastName",

"email": "[email protected]"

}

},

{

"createdDateTime": "2023-11-20T00:01:25.0257408",

"merchantId": "KPC_211-TEST",

"kapchargeTransactionId": 12648285,

"clientReference": "ScheduleTest",

"transactionStatus": "Accepted",

"transactionFlow": "Pay",

"transactionMethod": "Interac",

"amountInCents": 110,

"customer": {

"customerFullName": "CustomerFirstName CustomerLastName",

"email": "[email protected]"

}

}

],

"currentPage": 1,

"pageCount": 1,

"pageSize": 10,

"rowCount": 2,

"firstRowOnPage": 1,

"lastRowOnPage": 2

}

Get Transaction Request Parameters

| Parameter | Type | Mandatory | Default | Description |

|---|---|---|---|---|

| MerchantId | String | Yes | Merchant id (maximum 15 characters). | |

| Page | Int | No | 1 | |

| PageSize | Int | No | 10 | |

| CreatedDateTimeFrom | DateTime | No | Transaction Created DateTime From (≥ selected 'From' date). | |

| CreatedDateTimeTo | DateTime | No | Transaction Created DateTime To (≤ selected 'To' date). | |

| DeclinedDateTimeFrom | DateTime | No | Transaction Declined DateTime From (≥ selected 'From' date). | |

| DeclinedDateTimeTo | DateTime | No | Transaction Declined DateTime To (≤ selected 'To' date). | |

| TransactionFlow | String | No | Either "Collect" or "Pay" only. | |

| TransactionStatus | String | No | Refer KAPCHARGE Bank Status Response Codes here. | |

| Source | Int | No | Refer KAPCHARGE Transaction Sources here. |

KAPCHARGE Transaction Sources

| Source Name | Source Code | Description |

|---|---|---|

| FILE | 1 | Indicates the transaction was created through File. |

| API | 5 | Indicates the transaction was created through API. |

| VT | 6 | Indicates the transaction was created through Virtual terminal. |

| ADR | 7 | Indicates the transaction was created through ADR. |

Cancel a specific transaction

HTTP Request

Method: DELETE

Endpoint: {{Application Url}}/api/v1/transaction/<TransactionID>

HTTP Request

Method: DELETE

Endpoint: {{Application Url}}/api/v1/transaction/<TransactionID>

Delete a specific transaction

curl --location -g --request DELETE '{{Application Url}}/api/v1/transaction/12345679'

Make sure to replace

{{Application Url}}with Application Url as per the environment.

The above command returns JSON structured like this:

{

"kapchargeTransactionId": 12345679,

"clientReference": "12345679",

"transactionStatus": "Cancelled",

"transactionFlow": "Collect",

"amountInCents": 200,

"transactionMethod": "EFT"

}

This endpoint deletes a specific transaction request based on transaction id.

Responses

| Parameter | Description |

|---|---|

| kapchargeTransactionId | The unique transaction ID generated by Kapcharge. |

| clientReference | Transaction reference provided by the client. |

| transactionStatus | Refer KAPCHARGE Bank Status Response Codes here. |

| transactionFlow | Either "Collect" or "Pay". |

| amountInCents | Transaction amount in cents. |

| transactionMethod | The paymentmethod used for the transaction (e.g., "EFT", "Interac", "CreditCard", "VisaDirect"). |

KAPCHARGE Transaction Status - EFT & Interac Payment Methods

| Status Name | Description | Payment Method |

|---|---|---|

| Created | Indicates the transaction was acknowledged by the bank/processor. | Interac |

| Processing | Indicates the transaction is being processed. | EFT,Interac |

| Accepted | Indicates the transaction was accepted by the bank/processor. | EFT,Interac |

| Cancelled | Indicates the transaction was cancelled by the merchant. | EFT,Interac |

| Returned | Indicates the transaction was returned by the bank. | EFT |

| Declined | Indicates the transaction was declined by the bank, processor or customer. | Interac |

| TxnError | Indicates the transaction has validation or connectivity error and was not successfully processed. | EFT,Interac |

| Fraud | Indicates the transaction was confirmed as Fraud by Kapcharge or Merchant. | Interac |

| FraudBlock | Indicates the transaction was flagged as a potential fraud transaction by Interac. | Interac |

Transaction API for V/MC Debit & V Direct

Create V/MC Debit and Visa Direct Transactions for a new customer

V/MC Debit and Visa Direct transactions are executed with a different endpoint and authorization key for a new customer.

| Name | Description |

|---|---|

| Skyflow endpoint | https://{{transaction_inbound_url}}/api/v1/transaction |

Create V/MC Debit and Visa Direct Transactions

Create V/MC Debit and Visa Direct Transactions

[

{

"MerchantId": "KPC_201-KPCHRG",

"Currency": "CAD",

"ClientReference": "referenceNewClient",

"AmountInCents": "121",

"DueDate": "2024-01-22",

"TransactionFlow": "Collect",

"TransactionMethod": "CreditCard",

"Customer": {

"FirstName": "Jane",

"LastName": "Smith",

"AddressLine1": "123 Main Street",

"city": "Toronto",

"country": "ca",

"province": "ON",

"postalcode": "M5H2N2",

"email": "[email protected]",

"PhoneNumber": "4165551234"

},

"CustomerCreditCard": {

"Number": "4111111111111111",

"ExpiryMonth": "12",

"ExpiryYear": "27",

"Cvv": "999"

}

}

]

HTTP Request

Method: POST

Endpoint: {{ transaction_inbound_url }}/api/v1/transaction

Transaction Request

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

| MerchantId | String | Yes | Merchant id (maximum 15 characters). |

| Currency | String | Yes | Either "CAD" or "USD" only (maximum 3 characters). |

| ClientReference | String | Yes | Client Reference (maximum 100 characters). |

| AmountInCents | Integer | Yes | Transaction amount in cents. |

| DueDate | String | Yes | Due date for the transaction (Format: YYYY-MM-DD). |

| TransactionFlow | String | Yes | Either "Collect" for V/MC debit or "Pay" for VisaDirect. |

| TransactionMethod | String | Yes | CreditCard or VisaDirect. |

| Customer | Object | Yes | Pass the Customer object with all the required details as seen in Customer. |

| CustomerCreditCard | Object | Yes | The V/MC Debit or Visa direct information of the customer. |

Customer Credit Card

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

| Number | String | Yes | Card number. |

| ExpiryMonth | String | Yes | The 2 digits of card expiration month. |

| ExpiryYear | String | Yes | The last 2 digits of card expiration year. |

| Cvv | String | Yes | The 3-4 digits of Cvv (Card Verification Value) the security feature on credit cards |

The above command returns JSON structured like this:

Status Code : 200 OK

[

{

"amountInCents": 121,

"clientReference": "referenceNewClient",

"customer": {

"creditCardToken": "4111115933501111",

"customerFullName": "JANE SMITH",

"email": "[email protected]"

},

"kapchargeTransactionId": 12676894,

"responseCode": "100",

"transactionFlow": "COLLECT",

"transactionStatus": "Accepted"

}

]

Responses

| Parameter | Description |

|---|---|

| amountInCents | Transaction amount in cents. |

| clientReference | Transaction reference provided by the client. |

| Customer | The Customer response information Object |

| kapchargeTransactionId | The unique transaction ID generated by Kapcharge. |

| responseCode | The response code of the transaction. |

| transactionFlow | Either "Collect" for V/MC debit or "Pay" for VisaDirect. |

| transactionStatus | Refer KAPCHARGE Bank Status Response Codes here. |

Customer response information

| Parameter | Description |

|---|---|

| creditCardToken | A token generated when a transaction is created for a new customer. |

| customerFullName | The full name of the new created customer. |

| The email of the new created customer. |

KAPCHARGE Transaction Status - V/MC Debit & V Direct Payment Methods

| Status Name | Description |

|---|---|

| Processing | Indicates the transaction is being processed. |

| Accepted | Indicates the transaction was accepted by the processor. |

| Cancelled | Indicates the transaction was cancelled by the merchant. |

| Declined | Indicates the transaction was declined by the processor. |

| TxnError | Indicates the transaction has validation or connectivity error and was not successfully processed. |

Create V/MC Debit and Visa Direct Transactions for an existing customer

To create a V/MC Debit and Visa Direct transaction for an existing customer you need the creditCardToken generated when the first transaction for the customer was created. You only need to provide the creditCardToken in the CustomerCreditCard object if (ExpirationMonth, ExpiryYear, CVV, Number) are not send. You will use the Kapcharge endpoint to create a transaction for an existing customer.

Sample Request Payload

Sample Request Payload

[

{

"MerchantId": "KPC_201-KPCHRG",

"Currency": "CAD",

"ClientReference": "referenceClient",

"AmountInCents": "121",

"DueDate": "2024-01-22",

"TransactionFlow": "Collect",

"TransactionMethod": "Collect",

"Customer": {

"FirstName": "Jane",

"LastName": "Smith",

"AddressLine1": "123 Main Street",

"city": "Toronto",

"country": "ca",

"province": "ON",

"postalcode": "M5H2N2",

"email": "[email protected]",

"PhoneNumber": "4165551234"

},

"CustomerCreditCard": {

"Token": "4111115933501111",

}

}

]

HTTP Request

Method: POST

Endpoint: {{ Application URL }}/api/v1/transaction

Transaction Request

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

| MerchantId | String | Yes | Merchant id (maximum 15 characters). |

| Currency | String | Yes | Either "CAD" or "USD" only (maximum 3 characters). |

| ClientReference | String | Yes | Client Reference (maximum 100 characters). |

| AmountInCents | Integer | Yes | Transaction amount in cents. |

| DueDate | String | Yes | Due date for the transaction (Format: YYYY-MM-DD). |

| TransactionFlow | String | Yes | Either "Collect" for V/MC debit or "Pay" for VisaDirect. |

| TransactionMethod | String | Yes | CreditCard or VisaDirect. |

| Customer | Object | Yes | Pass the Customer object with all the required details as seen in Customer. |

| CustomerCreditCard | Object | Yes | the V/MC Debit or Visa direct information of the customer. |

Customer Credit Card info

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

| Token | String | Yes if (ExpirationMonth, ExpiryYear, CVV, Number) are not send | The generated token provided after the creation of the first transaction for the customer. |

The above command returns JSON structured like this: Status Code : 200 OK

[

{

"kapchargeTransactionId": 12676894,

"clientReference": "referenceClient",

"transactionStatus": "Accepted",

"transactionFlow": "COLLECT",

"amountInCents": 121,

"customer": {

"customerFullName": "JANE SMITH",

"email": "[email protected]",

"creditCardToken": "4111115933501111",

}

}

]

Responses

| Parameter | Description |

|---|---|

| kapchargeTransactionId | The unique transaction ID generated by Kapcharge. |

| clientReference | Transaction reference provided by the client. |

| transactionStatus | Refer KAPCHARGE Bank Status Response Codes here. |

| transactionFlow | Either "Collect" for V/MC debit or "Pay" for VisaDirect. |

| amountInCents | Transaction amount in cents. |

| Customer | Customer response information Object. |

Refund a transaction

You have the possibility to refund a customer by using the request bellow.

HTTP Request

Method: DELETE

Endpoint: {{Application Url}}/api/v1/transaction/refund/<TransactionID>

Refund a specific transaction

HTTP Request

Method: DELETE

Endpoint: {{Application Url}}/api/v1/transaction/refund/<TransactionID>

Refund a specific transaction

curl --location -g --request DELETE '{{Application Url}}/api/v1/transaction/refund/56345679'

Make sure to replace

{{Application Url}}with Application Url as per the environment.

The above command returns JSON structured like this:

{

"kapchargeTransactionId": 56345679,

"transactionStatus": "Accepted",

"transactionFlow": "Collect",

"amountInCents": 200

}

This endpoint refund a specific transaction request based on transaction id.

Responses

| Parameter | Description |

|---|---|

| kapchargeTransactionId | The unique transaction ID generated by Kapcharge. |

| transactionStatus | Refer KAPCHARGE Bank Status Response Codes here. |

| transactionFlow | Either "Collect" or "Pay". |

| amountInCents | Transaction amount in cents. |

Webhook for All Status Updates

Overview

Kapcharge now provides webhook notifications for all transaction statuses to enhance real-time transaction tracking and improve merchant experience. This allows merchants to receive updates for each transaction state, enabling them to react promptly and optimize their payment processing workflows.

Webhook Triggers for All Statuses

The system triggers webhook notifications for the following transaction statuses:

- Processing

- Accepted

- Cancelled

- Returned

- Declined

- TxnError

- Fraud

- FraudBlock

Payload Structure

The webhook payload includes the following fields:

transactionId: Unique identifier for the transaction.status: The current status of the transaction.statusDescription: Human-readable description of the status.dateTime: Timestamp of the status update.

Webhook Configuration API Updates

The PUT /api/v1/webhookConfiguration endpoint allows enabling webhooks for all statuses. The API supports an optional parameter to select which statuses the merchant wants to receive notifications for.

HTTP Request

Method: PUT

Endpoint: {{Application Url}}/api/v1/webhookConfiguration

Update Merchant Webhooks Configuration Payload

{

"merchantId": "TEST_123-KC",

"webhookEnabled": true,

"webhookUrl": "https://www.webhook.com/",

"webhookAuthenticationHeader": "TEST AUTH HEADER",

"subscribeStatuses": ["Processing", "Accepted", "Returned"]

}

Parameters

| Parameter | Type | Mandatory | Description |

|---|---|---|---|

| merchantId | String | Yes | The unique merchant ID generated by Kapcharge. |

| webhookEnabled | Boolean | Yes | true => Enable webhook notifications, false => Disable webhook notifications. |

| webhookUrl | String | Yes | Merchant webhook URL. |

| webhookAuthenticationHeader | String | Yes | Merchant webhook authentication header. |

| subscribeStatuses | Array of Strings | Yes | List of transaction statuses for which the merchant wants to receive notifications. |

Responses

{

"id": 3,

"merchantId": "TEST_123-KC",

"webhookEnabled": true,

"webhookUrl": "https://www.webhook.com/",

"subscribeStatuses": [

"Processing",

"Accepted",

"Returned"

],

"creationDate_UTC": "2025-03-11T16:06:13.277",

"lastUpdateDate_UTC": "2025-03-27T16:01:23.8065217Z"

}

| Parameter | Description |

|---|---|

| id | The unique ID of the webhook configuration. |

| merchantId | The unique merchant ID generated by Kapcharge. |

| webhookEnabled | Boolean, true => Webhook notifications enabled, false => Webhook notifications disabled. |

| webhookUrl | Merchant webhook URL. |

| subscribeStatuses | List of transaction statuses for which the merchant will receive notifications. |

| creationDate_UTC | The creation date of the webhook configuration in UTC. |

| lastUpdateDate_UTC | The last update date of the webhook configuration in UTC. |

Webhook message Body

The webhook message body includes the following fields:

{

"status": "Accepted",

"statusDescription": "Accepted",

"changeDate": "2025-03-25T15:14:42.6848316-04:00",

"returnCode": "900",

"returnDateTime": "2025-05-08T15:40:31.5342526-04:00",

"transactionId": 12699593,

"transactionMethod": "EFT"

}

| Parameter | Type | Description |

|---|---|---|

| status | String | The current status of the transaction. |

| statusDescription | String | Human-readable description of the status. |

| changeDate | DateTime | Timestamp of the status update. |

| transactionId | Integer | Unique identifier for the transaction. |

| transactionMethod | String | The method of the transaction (e.g., EFT, Interac) |

Return Code Simulator

When testing return scenarios in the staging environment, it is important to simulate return or decline events properly.

To simulate different return or decline results during transaction creation, you must pass a specific code within the ClientReference field, based on the payment method:

| Payment Method | Format | Example |

|---|---|---|

| Interac | return_code:[status] |

return_code:deposit_failed |

| EFT | return_code:[code] |

return_code:900 |

| V/MC Debit | decline_code:[code] |

decline_code:200 |

| Visa Direct | decline_code:[code] |

decline_code:01 |

Instructions:

- Insert the corresponding return or decline code within the ClientReference field of your transaction request.

- Ensure there are no spaces between return_code: or decline_code: and the value.

- This will trigger the intended return or decline behavior automatically in the system for testing purposes.

Sample Request Payload for Return Simulation (EFT)

[

{

"MerchantId": "TEST_123-KC",

"Currency": "CAD",

"ClientReference": "return_code:900",

"AmountInCents": 5000,

"DueDate": "2025-05-01",

"TransactionFlow": "Collect",

"TransactionMethod": "EFT",

"Customer": {

"FirstName": "John",

"LastName": "Smith",

"CompanyName": "Demo Corp",

"AddressLine1": "456 Main Street",

"City": "Vancouver",

"Country": "CA",

"Province": "BC",

"PostalCode": "V5K0A1",

"Email": "[email protected]",

"PhoneNumber": "6045556789"

},

"CustomerBankAccount": {

"InstitutionName": "ABC Bank",

"InstitutionNumber": "001",

"TransitNumber": "12345",

"AccountNumber": "1234567",

"AccountOwnershipType": "INDIVIDUAL"

}

}

]

In this example:

- ClientReference is set to "return_code:900".

- This will simulate an EFT Edit Reject return.

These examples help ensure accurate testing and validation of your integration!

Decline Codes

EFT Decline Codes

| Decline Code | Description |

|---|---|

| 900 | Edit Reject |

| 901 | NSF (Debit Only) |

| 902 | Account not found |

| 903 | Payment Stopped/Recalled |

| 904 | Payment Stopped or Revoked |

| 905 | Account Closed |

| 907 | No Debit Allowed |

| 908 | Funds Not Cleared (Debit Only) |

| 909 | Currency/Account Mismatch |

| 910 | Payor/Payee Deceased |

| 911 | Account Frozen |

| 912 | Invalid/Incorrect Account No. |

| 914 | Incorrect Payor/Payee Name |

| 915 | No Agreement Existed |

| 916 | Not According to Agreement - Personal |

| 917 | Agreement Revoked – Personal |

| 918 | No Confirmation/Pre-Notification – Personal |

| 919 | Not According to Agreement – Business |

| 920 | Agreement Revoked – Business |

| 921 | No Confirmation/Pre-Notification – Business |

| 922 | Customer Initiated Return |

| 990 | Institution in Default |

| 996 | No Agreement |

Interac Decline Codes

| Decline Code | Description |

|---|---|

| 800 | Customer Declined |

| 801 | Deposit Failed |

| 802 | Security Answer Failure |

| 803 | Deposit Pending |

| 804 | Expired |

V/MC Card Decline Codes

| Decline Code | Description |

|---|---|

| 200 | Transaction was declined by processor. |

| 201 | Do not honor. |

| 202 | Insufficient funds. |

| 203 | Over limit. |

| 204 | Transaction not allowed. |

| 220 | Incorrect payment information. |

| 221 | No such card issuer. |

| 222 | No card number on file with issuer. |

| 223 | Expired card. |

| 224 | Invalid expiration date. |

| 225 | Invalid card security code. |

| 226 | Invalid PIN. |

| 240 | Call issuer for further information. |

| 250 | Pick up card. |

| 251 | Lost card. |

| 252 | Stolen card. |

| 253 | Fraudulent card. |

| 260 | Declined with further instructions available. (See response text) |

| 261 | Declined-Stop all recurring payments. |

| 262 | Declined-Stop this recurring program. |

| 263 | Declined-Update cardholder data available. |

| 264 | Declined-Retry in a few days. |

| 300 | Transaction was rejected by gateway. |

| 400 | Transaction error returned by processor. |

| 410 | Invalid merchant configuration. |

| 411 | Merchant account is inactive. |

| 420 | Communication error. |

| 421 | Communication error with issuer. |

| 430 | Duplicate transaction at processor. |

| 440 | Processor format error. |

| 441 | Invalid transaction information. |

| 460 | Processor feature not available. |

| 461 | Unsupported card type. |

Visa Direct Decline Codes:

| Decline Code | Description |

|---|---|

| 01 | Refer to card issuer |

| 02 | Refer to card issuers special conditions |

| 03 | Invalid merchant |

| 04 | Pick-up |

| 05 | Do not honor |

| 06 | Error |

| 07 | Pick-up card, special conditions |

| 08 | Honor with identification |

| 09 | Request in progress |

| 10 | Approved for partial amount |

| 11 | Approved (VIP) |

| 12 | Invalid transaction |

| 13 | Invalid amount |

| 14 | Invalid card number (no such number) |

| 15 | No such issuer |

| 16 | Approved, update track 3 |

| 17 | Customer cancellation, reversal (unsupported) |

| 18 | Customer dispute, chargeback (future) |

| 19 | Re-enter transaction |

| 20 | Invalid response |

| 21 | No action taken, reversal (unsupported) |

| 22 | Suspected malfunction, reversal (unsupported) |

| 23 | Unacceptable transaction fee |

| 24 | File update not supported by receiver |

| 25 | Unable to locate record on file |

| 26 | Duplicate file update record, no action |

| 27 | File update field edit error |

| 28 | File update record locked out |

| 29 | File update not successful, contact acquirer |

| 30 | Format error (may also be a reversal) |

| 31 | Bank not supported by switch |

| 32 | Completed partially, reversal (unsupported) |

| 33 | Expired card, pick-up |

| 34 | Suspected fraud, pick-up |

| 35 | Card acceptor contact acquirer, pick-up |

| 36 | Restricted card, pick-up |

| 37 | Card acceptor call acquirer security, pick-up |

| 38 | Allowable PIN tries exceeded, pick-up |

| 39 | No credit account |

| 40 | Requested function not supported |

| 41 | Lost card, pick-up |

| 42 | No universal account |

| 43 | Stolen card, pick-up |

| 44 | No investment account |

| 45 | Reserved for ISO use |

| 46 | Reserved for ISO use |

| 47 | Reserved for ISO use |

| 48 | Reserved for ISO use |

| 49 | Reserved for ISO use |

| 50 | Reserved for ISO use |

| 51 | Insufficient funds |

| 52 | No checking account |

| 53 | No savings account |

| 54 | Expired card |

| 55 | Incorrect PIN |

| 56 | No card record |

| 57 | Transaction not permitted to cardholder |

| 58 | Transaction not permitted to terminal (may also be a chargeback) |

| 59 | Suspected fraud |

| 60 | Card acceptor contact acquirer |

| 61 | Exceeds withdrawal amount limit |

| 62 | Restricted card |

| 63 | Security violation (may also be a chargeback) |

| 64 | Original amount incorrect, reversal (unsupported) |

| 65 | Exceeds withdrawal frequency limit |

| 66 | Card acceptor call acquirer security |

| 67 | Hard capture, pick-up |

| 68 | Response received too late, reversal (unsupported) |

| 69 | Reserved for ISO |

| 70 | Reserved for ISO |

| 71 | Reserved for ISO |

| 72 | Reserved for ISO |

| 73 | Reserved for ISO |

| 74 | Reserved for ISO |

| 75 | Allowable number of PIN tries exceeded |

| 76 | Key synchronization error (FIS) |

| 77 | Reserved for private use |

| 78 | Customer not eligible for POS (Star SM ) |

| 79 | Invalid digital signature |

| 80 | Stale dated transaction (Star SM ) |

| 81 | Issuer requested standin |

| 82 | Count exceeds limit (VISANet) |

| 83 | Reserved for private use |

| 84 | Time limit for pre-authorization reached (VISANet) |

| 85 | Issuer has no reason to decline the transaction (Account Verification) |

| 86 | Cannot verify PIN (VISANet) |

| 87 | Check already posted |

| 88 | Information not on file |

| 89 | Card verification value (CVV) verification failed (no pickup) |

| 90 | Cutoff is in progress |

| 91 | Issuer or switch is inoperative |

| 92 | Financial institution or intermediate network unknown for routing |

| 93 | Transaction cannot be completed, violation of law |

| 94 | Duplication transaction |

| 95 | Reconcile error |

| 96 | System malfunction |

| 97 | Reserved for national use |

| 98 | Reserved for national use |

| 99 | Card network fault error |

| 0Z-9Z | Reserved for ISO use |

| C2-E0 | Reserved for national use (X9.2) |

| EZ-MZ | Reserved for national use (X9.2) |

| N0 | Authorization life cycle unacceptable |

| N1 | Authorization life cycle expired |

| R2 | Allowable PAN entries warning -- approved |

| R3 | Approved with overdraft protection |

| R4 | Bad CVV3 |

| S0 | Check not acceptable for cash |

| S1 | Check not acceptable |

| S2 | Check deposit limit exceeded |

| S3 | Cash back limit exceeded |

| S4 | Check amount does not match courtesy amount |

| S5 | PIN not selected |

| S6 | PIN already selected |

| S7 | Unmatched voucher information |

| S8 | Allowable PAN entries exceeded -- denial |

| S9 | Expiration date mismatch |

| SA | Inactive card |

| SB | Expiration date mismatch (card pickup) |

| SC | Item suspected for stop pay |

| SD | Account closed |

| SE | Ineligible account |

| SF | Item submitted more than two times |

| SG | No account on file - absolute |

| SH | Unable to locate |

| SI | General denial |

| SJ | Item settled via ACH |

| SK | Cross-reference card not found |

| SL | Category limit exceeded |

| SM | Transaction limit exceeded |

| SN | Daily limit exceeded |

| SO | Monthly limit exceeded |

| SP | Invalid secret code |

| SQ | PIN key sync error |

| SR | Bad CVV2 |

| SS | Stop payment order |

| ST | Revocation of authorization order |

| SV | Stop reoccurring payments |

| T3 | Lost card (no pickup) |

| T4 | Closed account |

| T5 | Dormant account |

| T6 | Special conditions (no pick-up) |

| T7 | Purchase only approval for purchase with cash back transaction. |

| T9 | Insufficient funds for fees |

| TA | ARQC validation failed for chip card |

| TB | Unsafe PIN |

| U0-YZ | Reserved for private use |

For more details kindly refer to: Payments Canada (LIST OF RETURN REASON CODES ,Page 9-10)